Business Activity in the Field: what are companies doing and why?

by Geoffrey Banda, James Mittra and Joyce Tait

The REGenableMED project work-package on business models, value chains and innovation ecosystems investigated 10 UK case studies composed of 7 private firms, 1 public organisation, 1 university spin off and 1 research and development consortium. The choice of case studies was based on accessibility and those that agreed to be interviewed amongst the identified organisations in the UK. Of the 10 organisations we investigated none had acquired marketing authorisation in the UK or internationally, and only one firm (which is now non-operational) had used the specials route for unlicensed medicines to get partial re-imbursement during clinical trials in the UK. This shows that the prevalent stage in the lab-to-clinic value chain with the most activities, at least in the UK, is in development and clinical trials phases 1 and 2; hence as we shall discuss later the need for investment in innovation infrastructure for technology development, manufacturing, quality assurance and navigating regulation and governance issues.

We investigated the following aspects for the 10 case studies:

- types of organisations

- therapy areas

- anticipated products

- funding models,

- technology-readiness levels, and

- ability to manufacture in-house or to use contract manufacturing,

- competition,

- regulation,

- and the linkages at micro and macro level critical for supporting the growth of this emerging sector of the bio-economy.

The sector is dominated by small to medium enterprises (SMEs) and a mixture or university spin-offs, public organisations (blood and tissues services) and research and development consortia. However there are multinational companies that are active in the regenerative medicine space in the UK and internationally. The therapies in the case studies covered both allogeneic and autologous domains and one organisation was involved in developing stem cells for drug development signifying the potential beneficial linkages between regenerative medicine and chemical drug development especially for diseases for which tissue is difficult to obtain, for example brain-type diseases. Funding was a mixture of grants, private equity and public sources ranging in scale from £5 to 70 million with most of the activities concentrated in clinical trials phases 1 and 2. Therapy areas ranged from ophthalmology, oncology, bone, blood and tissue regeneration.

The business models

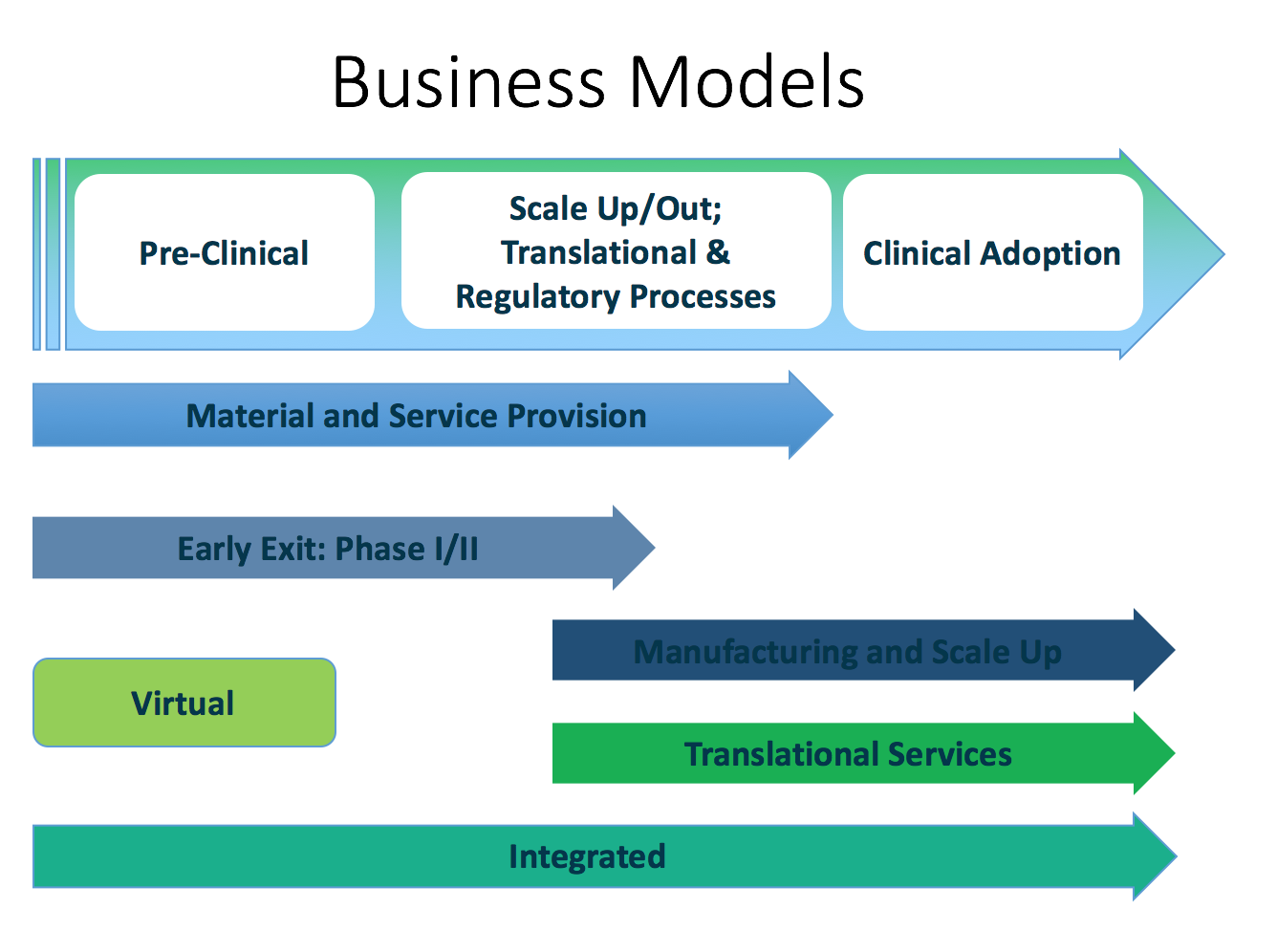

Our evidence suggests that players in the field have different commercial, strategic and firm growth strategies. As a result how much of the regenerative medicine value chain a firm engages with determines at which stage it extracts value or exists the value chain as described below. The regenerative medicine value chain and innovation ecosystem can be broadly classified into the following:

- funders: consisting of charities, research councils, Innovate UK, Private Equity and others

- innovation infrastructure provided mostly by NHS blood and transfusions services

- innovation brokers such as the Cell and Gene Therapy Catapult, contract research organisations, and contract manufacturing organisations

- innovation anchors such as industry strategy, health policy, and innovation policy

- suppliers of material and services to the sector

- technology adoption gatekeeper which include health technology assessors, standards bodies and market authorisation agencies

- therapy trial and adoption space characterised by the clinic and patient groups

Within this complex innovation system and the attendant value chains, the following are the business models we identified.

(1) The Material and Service Provision business model is characterised by organisations that provide tangible inputs as well as services to organisations in the regenerative medicine value chain. Amongst these are reagent, equipment, cell and tissue production as well as regulatory advisory organisations. These organisations are able to generate cash as they supply those in development and clinical trial activities.

(2) Early Exit: Phase 1/2 business model are made up of actors not interested in commercial exploitation of their development work. They provide proof of concept and a measure of efficacy and with the objective of selling-off to organisations keen on translational activities and commercial exploitation.

(3) The Manufacturing and Scale Up business model is made up of the actors in the value chain who have specialised in manufacturing and production activities that include scaling up production processes and developing assaying and validation processes. This is the second class of entities that are currently generating revenue from their operations as contract manufacturers for therapy developers especially those entering clinical trial stages that requires substantial amounts of cells and tissue.

(4) The Translational Services business model covers those organisations that offer service and product related services for clients who contract-out their requirements to specialists (see virtual business model below) in order to reduce their cash burn rate or because they do not possess the requisite skills in-house. Translational services can include assaying or quality assurance validation processes, regulatory or other compliance services.

(5) The Virtual business model: Except for organisations involved in the Material and Service Provision or Manufacturing and Scale Up business models, most of the actors in the field are in the cash-burn phase of their life cycle which is not matched by commensurate revenue generation. As a result management deploys strategies to limit the cash burn rate and use the Virtual business model to limit permanent full term employment of skills and subsequent long term investment in infrastructure. By contracting out development, production, quality assurance and regulatory activities the organisations interact with the other firms/organisations’ Translational Services or Manufacturing and Scale Up business models.

(6) The Fully Integrated business model which is at this point is aspirational, encompasses the incorporation of all the business models (1) to (5) within internal operations/capabilities of one organisation. The integrated model was the favourite for immunotherapy development organisations, reflecting the manageable scale of operations compared to the more complex operations for example organisations operating in the tissue and organ regeneration space that require more manipulation. At this point this business model is aspirational due to the resource-intensity that it requires and can be afforded by large scale organisations only.

Across all the business models respondents highlighted the urgent need to develop and retain manufacturing, quality assurance and research and development skills, because technological capabilities dominate management’s focus as most therapies are at development stages or clinical phases 1 and 2. The NHS clinical services or blood transfusion services was a prominent actor in the innovation ecosystem providing an innovation infrastructure and key development and translational activities for all the case studies we investigated. For example Guy’s Hospital and Great Ormond Street Hospital are clinical settings used in therapy development and clinical trials. Thus the NHS - clinical and transfusion services, and translational service providers like the Cell and Gene Therapy Catapult, provide key innovation infrastructure that will be indispensable for the future of the field in the UK

Our evidence points to the fact that getting marketing authorisation does not mean the commencement of revenue inflows; health economics data and skills are therefore required for negotiating reimbursement. However, there could be cases where private healthcare funded by medical insurance or out of pocket expenses can make therapy available to patients. The difficulty with this approach is adoption of regenerative medicine therapy is likely to be small scale and unsustainable in the long run. Private insurers are reported to demand a high threshold for re-imbursement, thus negotiating sustainable reimbursement models are competencies that need to be strategically managed. In the USA Apligraf a cell based therapy for venous leg ulcers and diabetic foot ulcers was affected by the (CMS) Centre for Medicare and Medicaid Services ‘reduced reimbursement levels and this forced the firm to lay off staff in 2014. The same challenges were faced by Dermagraft with their foot ulcer therapy in the USA. This underscores the need to resolve re-imbursement issue for regenerative medicine therapies.